Demand Letter for Payment Template

In the business realm, unpaid invoices are an unwelcome yet common scenario. When you're on the receiving end of an outstanding payment, it can feel challenging to navigate the situation. You don't want to harm your relationships with your clients, but you also need to protect your financial interests. In such cases, a "demand letter for payment" can be a powerful tool. This article will demystify the concept of a demand letter for payment, shedding light on everything from its definition, the factors to consider before sending one, costs, benefits, key elements, a step-by-step writing guide, and what to avoid. It will also provide insights into post-writing steps, legal considerations, and the pros and cons of hiring a lawyer.

Table of Contents

If you are looking for other templates or a general introduction to the concept of demand letters, please have a look at our demand-letter guide.

What is a demand letter for payment?

A demand letter for payment is more than just a simple letter—it’s a legal document. Typically prepared by an attorney, a demand letter outlines a dispute and proposes specific actions for the recipient to undertake as a resolution, often serving as a prelude to formal legal proceedings. The main objective is to seek payment without having to go to court.

Need a different format? Browse all demand letter templates.

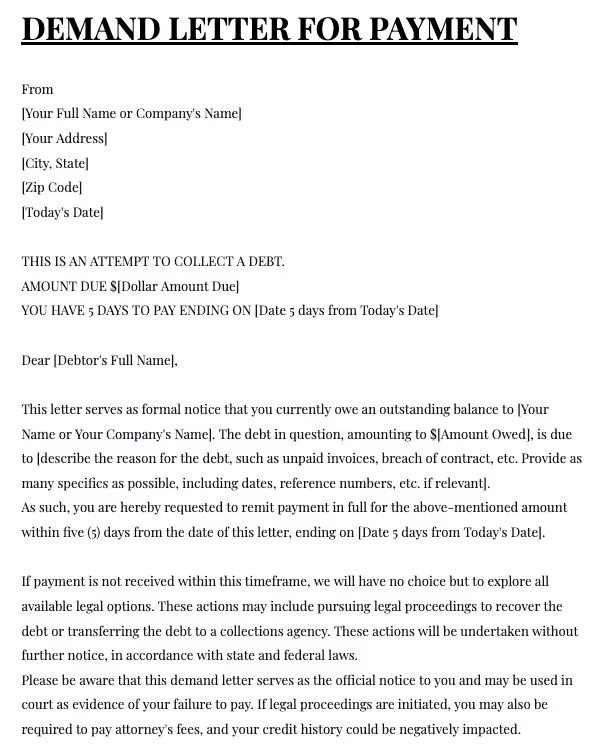

Demand letter for payment sample

This demand letter for payment sample can help you get started. Please note, that This is a general example of a demand for payment letter. The actual information and phrasing should be adapted based on your specific situation.

Demand Letter for Payment Template

From

[Your Full Name or Company's Name]

[Your Address]

[City, State]

[Zip Code]

[Today's Date]

THIS IS AN ATTEMPT TO COLLECT A DEBT.

AMOUNT DUE $[Dollar Amount Due]

YOU HAVE 5 DAYS TO PAY ENDING ON [Date 5 days from Today's Date]

Dear [Debtor's Full Name],

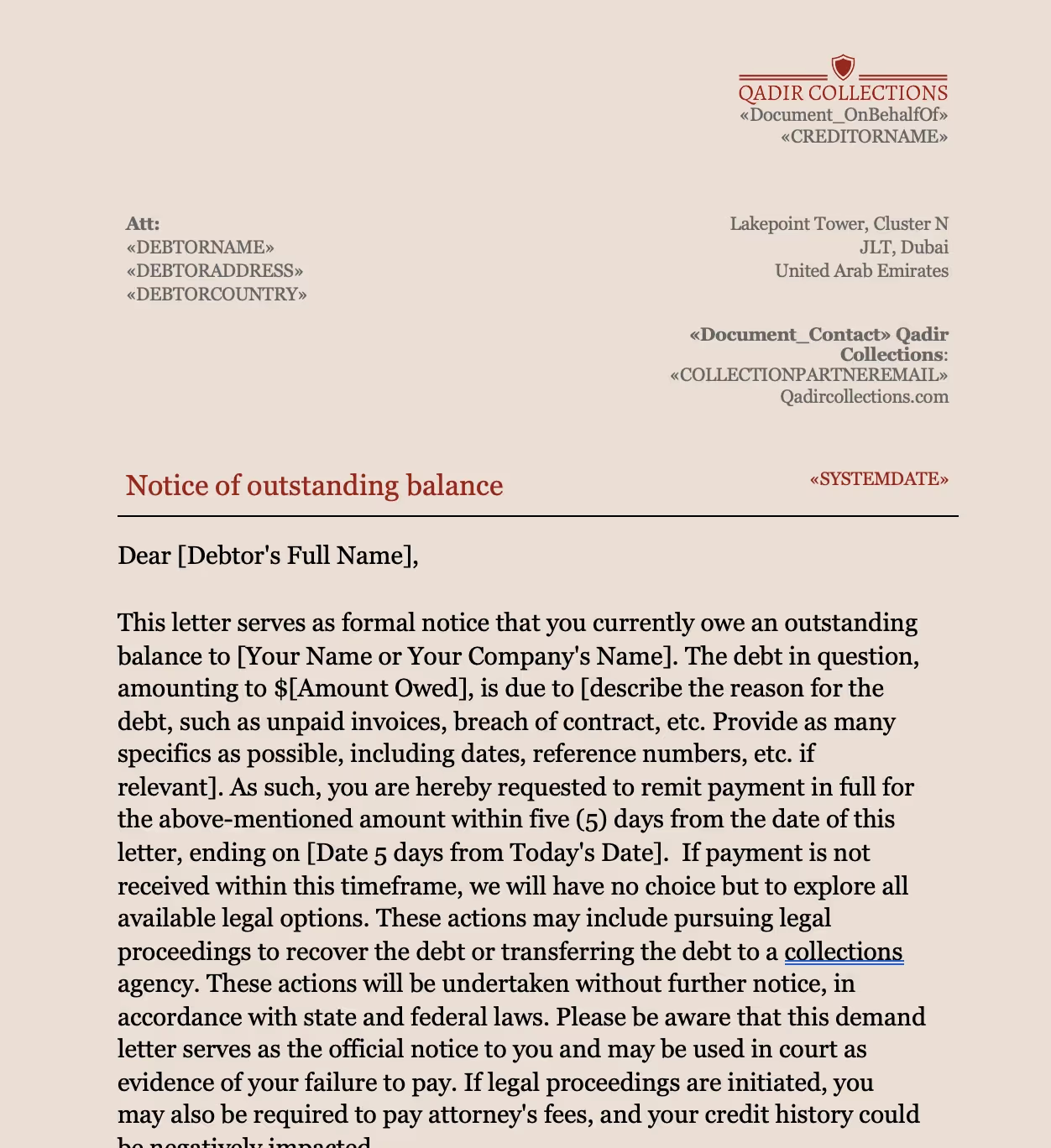

This letter serves as formal notice that you currently owe an outstanding balance to [Your Name or Your Company's Name]. The debt in question, amounting to $[Amount Owed], is due to [describe the reason for the debt, such as unpaid invoices, breach of contract, etc. Provide as many specifics as possible, including dates, reference numbers, etc. if relevant].

As such, you are hereby requested to remit payment in full for the above-mentioned amount within five (5) days from the date of this letter, ending on [Date 5 days from Today's Date].

If payment is not received within this timeframe, we will have no choice but to explore all available legal options. These actions may include pursuing legal proceedings to recover the debt or transferring the debt to a collections agency. These actions will be undertaken without further notice, in accordance with state and federal laws.

Please be aware that this demand letter serves as the official notice to you and may be used in court as evidence of your failure to pay. If legal proceedings are initiated, you may also be required to pay attorney's fees, and your credit history could be negatively impacted.

In order to make a payment, [describe the payment methods and process, such as bank transfer, online payment, sending a check, etc.]. If there is a dispute or you believe there has been a mistake, please contact us immediately at [Your Contact Information].

We urge you to treat this matter with the urgency it deserves to avoid any legal implications.

Enclosed with this letter are [mention any enclosed proof of debt, original contract, photographs, timelines, expert witness statements, insurance carrier's duties, or other relevant documents].

Thank you in advance for your prompt attention to this matter. We hope to resolve this without having to resort to formal legal proceedings.

Sincerely,

[Your Name or Company's Name]

[Your Signature]

Note: This is a general example of a demand for payment letter. The actual information and phrasing should be adapted based on your specific situation and legal counsel, as applicable. This information does not constitute legal advice and it is always best to consult with a legal professional in your area for tailored guidance.

Are you looking for other demand letter templates?

Klik here to browse our full library.

What Should You Consider Before Sending a Demand Letter for Payment?

Before you take the step of sending a demand letter for payment, consider the following:

- Start with Friendly Reminders or Direct Communication: Before turning to formal letters, try resolving the issue through direct conversation or gentle reminders.

- Gather Evidence to Strengthen Your Position: Your letter will carry more weight if you can substantiate your claims. Collect and prepare all relevant documents.

- Consider Cost and Time Implications: Consider the potential expenses and time commitment before proceeding.

Legal Considerations for Writing a Demand Letter for Payment

A well-crafted demand letter does more than demonstrate your good faith to resolve the dispute; it can potentially prevent a costly and time-consuming court case. Here are some legal aspects to bear in mind:

- Impact of the Demand Letter in Court: Remember that your demand letter may be used as evidence in court.

- Adhere to Contract Provisions and Legal Prerequisites: Make sure you are following all contractual provisions and legal prerequisites.

- Conduct Due Diligence: Investigate the circumstances fully before writing the letter.

Consider Timing: Be aware of the timing in relation to pending applications for federal registration.

What is the cost of drafting and sending a demand letter for payment?

Like other legal services, demand letters come with associated costs, and these can vary widely based on factors like location and the complexity of your case. To give you a ballpark, drafting and reviewing a demand letter usually costs around $305. However, legal fees can vary, with hourly rates for attorneys generally ranging from $250 to $350.

Should You Hire a Lawyer When Writing a Demand Letter for Payment?

While it's possible to draft a demand letter yourself, hiring a lawyer might add professional credibility, increasing the chances of getting a response. Lawyers also have expertise in crafting legally sound and persuasive letters. However, you must weigh these benefits against the potential costs, particularly for smaller claims.

Debitura is not a law firm or debt collection agency. Instead, we are a platform that connects you with vetted local collection agencies and lawyers worldwide. Leverage our network of 500+ local collection agencies and lawyers across 183 markets for effective, on-the-ground debt recovery.

•Hand-picked Agencies: We connect you with the best debt collection agencies and law firms worldwide.

•Performance-Based Selection: Our partners are constantly tested and evaluated to ensure top performance.

•Access to the Best: Only the best-performing agencies remain in our network, giving you access to superior debt recovery services regardless of where your debtors are.

Simplify your legal framework with our 'No Cure, No Pay' standardized agreement across all local partners. Ensuring convenience for international creditors, we offer a standard debt collection agreement across jurisdictions and local partners.

•No Cure, No Pay: Enjoy risk-free pre-legal debt collection with no upfront costs.

•Standardized Pre-legal Agreement: Our partners adhere to a transparent and standardized debt collection agreement, streamlining your legal framework across jurisdictions and partners.

•Competitive Legal Rates: For legal interventions (lawsuits, debt enforcement, insolvency proceedings, etc.), receive up to 3 competitive quotes from our network of local attorneys.

Explore our pricing

Quick, professional and hassle-free B2B and B2C debt collection. 87% Consistent recovery rate – a testament to our global effectiveness. 4.97/5 Average rating from a diverse global clientele of over 5,000.

Register for a free profile and effortlessly upload your claim within just 2 minutes. We match your request with our expansive network of over 500 attorneys and collection firms to get you started quickly.

Access competitive legal action rates worldwide through our network of 500+ local attorneys. For legal interventions (lawsuits, debt enforcement, insolvency proceedings, etc.), receive up to 3 competitive quotes from our network of local attorneys.

Consolidate all your cases worldwide in one platform. Enjoy seamless case upload, management, and reporting. Upload cases manually, via CSV files, or utilize our REST API for custom integrations with full technical support from our developers.

Advantages of a Demand Letter for Payment

Apart from facilitating payment, a demand letter brings numerous benefits to the table:

- Dispute Resolution: It encourages resolving disputes and increases the likelihood of reaching a settlement before escalating to court.

- Preparation for Potential Litigation: A well-crafted demand letter helps structure your case if it does escalate to legal proceedings.

- Authoritativeness: A demand letter carries more weight when issued by a lawyer, potentially inducing quicker action.

- Timeliness: It promotes a sense of urgency, encouraging the recipient to address the issue promptly.

- Shows Seriousness: A demand letter signals your willingness to escalate the matter if necessary.

Key Elements of a Demand Letter for Payment

An effective demand letter for payment should include the following components:

- Opening Statement: Clearly state your intentions for writing the letter.

- Clear Identification of Parties: State the involved parties, including their names and addresses.

- Explanation of the Issue: Detail the dispute or the payment issue in question.

- Specifics of the Debt: Be clear about the amount owed, including any interest or late fees.

- Demand for Action/Payment: Explicitly state the action you want the recipient to take.

- Payment Options: Provide different options for making the payment, such as bank transfer or check.

- Consequences of Non-compliance: Outline the possible legal repercussions if the debt is not settled.

- Dispute Instructions: If the debtor disputes the claim, provide instructions on how to communicate this.

- Deadline: Give a specific deadline by which the recipient must respond or pay.

- Supporting Documents: Attach any relevant supporting documents to back up your claim.

How to Write a Demand Letter for Payment: A Step-by-Step Guide

- Gather Evidence: Assemble all necessary documents to support your claim.

- Create a Timeline of Events: Make a chronological summary of events leading to the dispute.

- Set Clear Expectations: Clearly outline what you expect from the recipient.

- Determine the Appropriate Tone: Keep your tone professional and straightforward.

- Decide on Writing Yourself or Hiring a Lawyer: Weigh the pros and cons of drafting the letter yourself against hiring a professional.

- Outline the Demand Letter: Start with a basic outline before fleshing out the details.

- Write a Draft: Include all necessary elements in your draft.

- Review and Revise: Go over the letter and revise as necessary for clarity and persuasiveness.

- Proofread: Have someone else proofread the letter for grammar, spelling, and punctuation errors.

What to Avoid When Writing a Demand Letter for Payment

It’s important to remember that your demand letter will likely be scrutinized, so consider the following points:

- Maintain Professionalism: Keep your tone professional throughout the letter.

- Avoid Threats or Emotional Expressions: Stick to the facts, and avoid getting emotional.

- Stick to the Facts: Avoid any exaggeration or misrepresentation.

- Avoid Complex Legal Jargon: Keep your language clear and understandable, even for non-legal professionals.

What to Do After Writing a Demand Letter for Payment: A Guide to Next Steps

After writing the demand letter, you must consider the following steps:

- Sending the Demand Letter: Send the letter via certified mail with a return receipt or electronically with a confirmation of receipt.

- Negotiation Techniques: If the recipient responds and negotiations begin, remember to stay calm and professional, focusing on the facts at hand.

- Record Keeping and Documentation: Keep records of all your correspondence and related documents for future reference.

Timeline for Settlements: Understand that settlements can take anywhere from two weeks to a couple of months depending on the complexity of the case.

In conclusion, a demand letter for payment is a valuable tool for small business owners dealing with unpaid invoices. Understanding the nuances of writing and sending such a letter can equip you with a valuable skill set to protect your business's financial interests. However, remember that while this guide provides a solid starting point, every situation is unique and may require personalized legal advice.

.webp)

.svg)

.webp)